How can I know what the sales tax or value-added tax (VAT) will be on my purchase? – ForeFlight Support

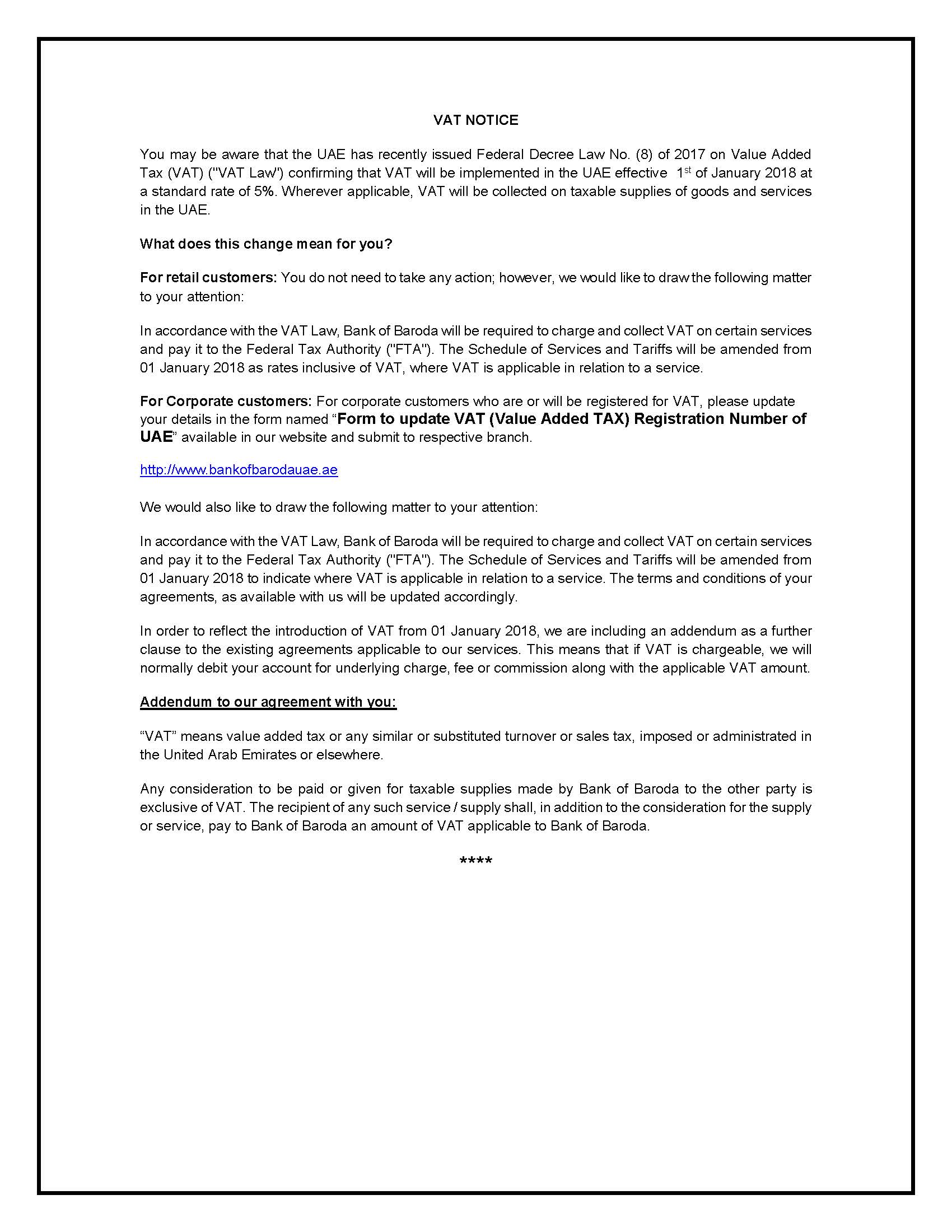

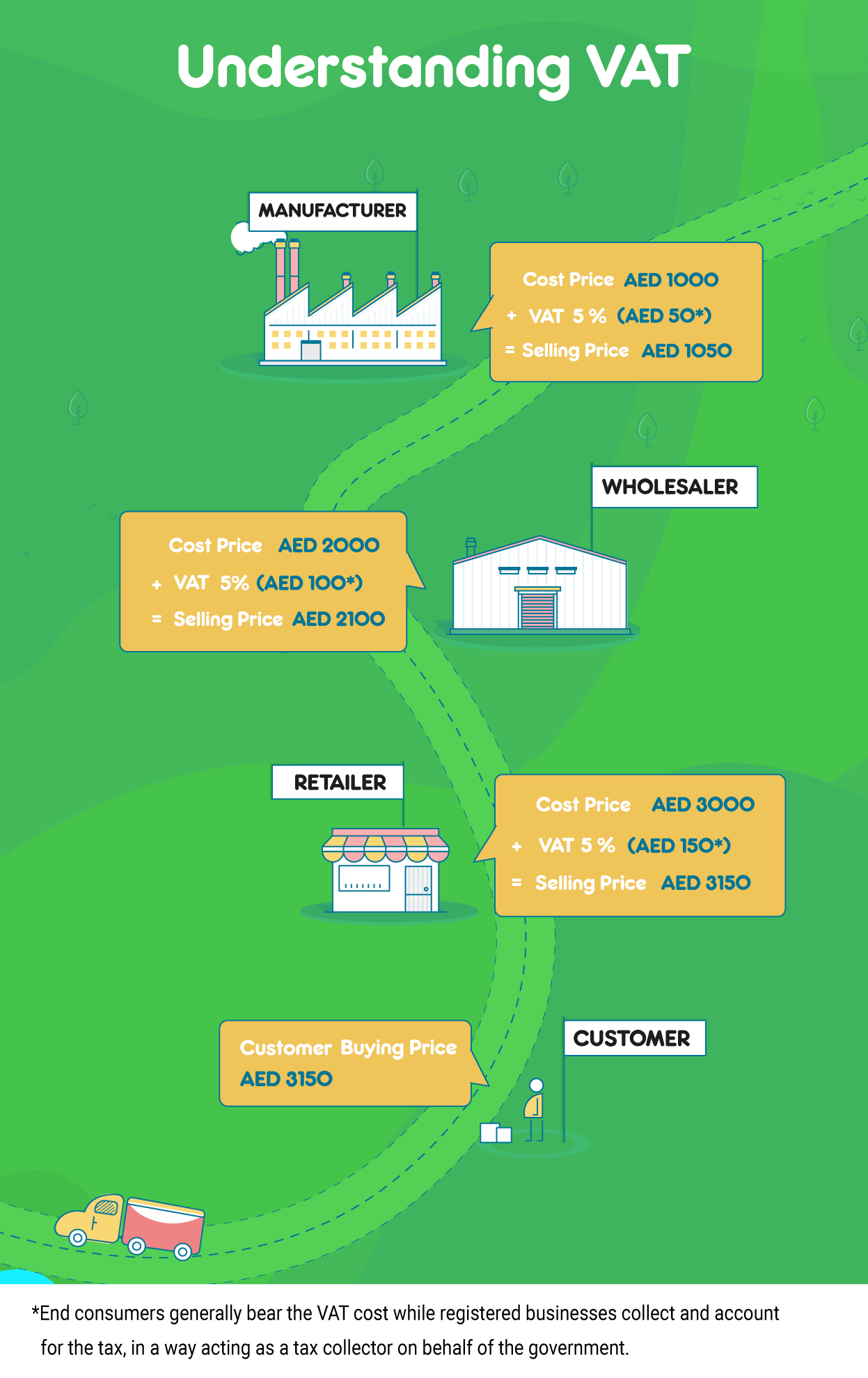

التواصل الحكومي on X: "Applying the #VAT in the Sultanate comes as per the unified agreement for VAT in the GCC countries. The VAT will be applied at a rate of 5%

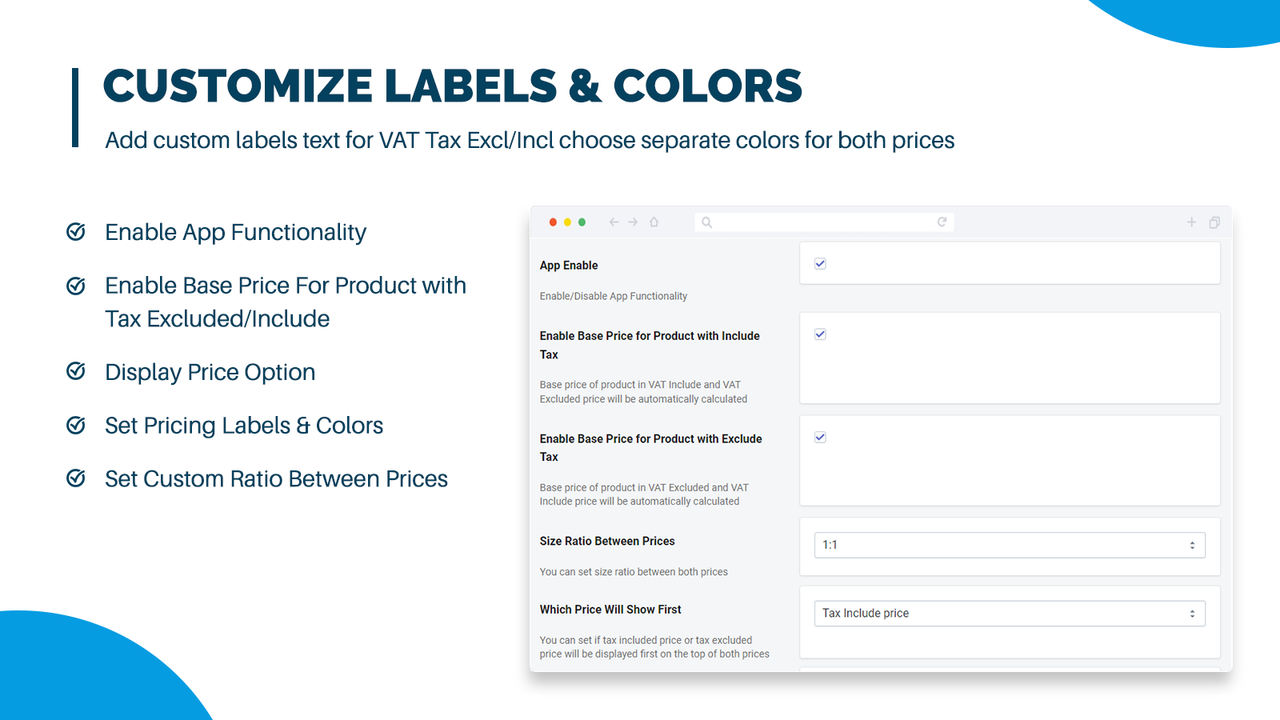

Extendons VAT Dual Pricing - Vat Dual Pricing App - VAT Include & Exclude Pricing | Shopify App Store

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)

/VAT-Banner-Slider-Banner-en.jpg?rev=91e4f40c1d5c4731b2d0bfd69ac39c2b&hash=0CD0120F0D018C03EA8E4D1DF3D94BE3)